Direct deposit for your invoices

Perfect for freelancers, consultants, and the companies who pay them.

$3 flat fee per transaction

No setup fee • No monthly subscription

Work Smarter

Go Checkless in 3 easy steps

Freelancers and consultants want digital payments, but end up waiting on paper checks because of escalating card processing fees. Get the best of both worlds with a flat fee and a convenient digital payment.

Create your verified account.

Tell us a little bit about yourself and connect your bank account.

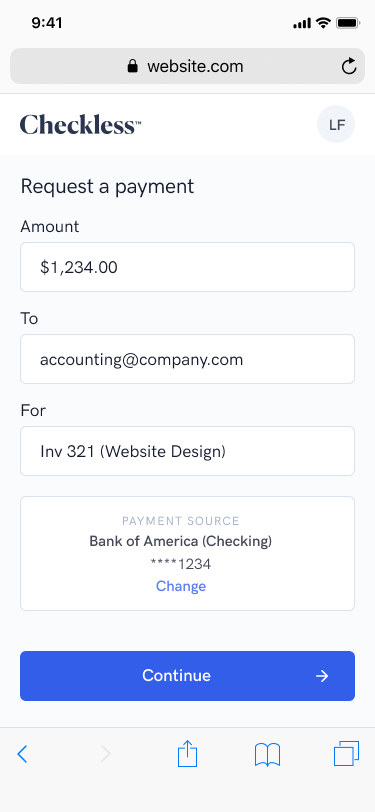

Request or send payments.

Tell Checkless where the payment should go or come from and we’ll do the rest.

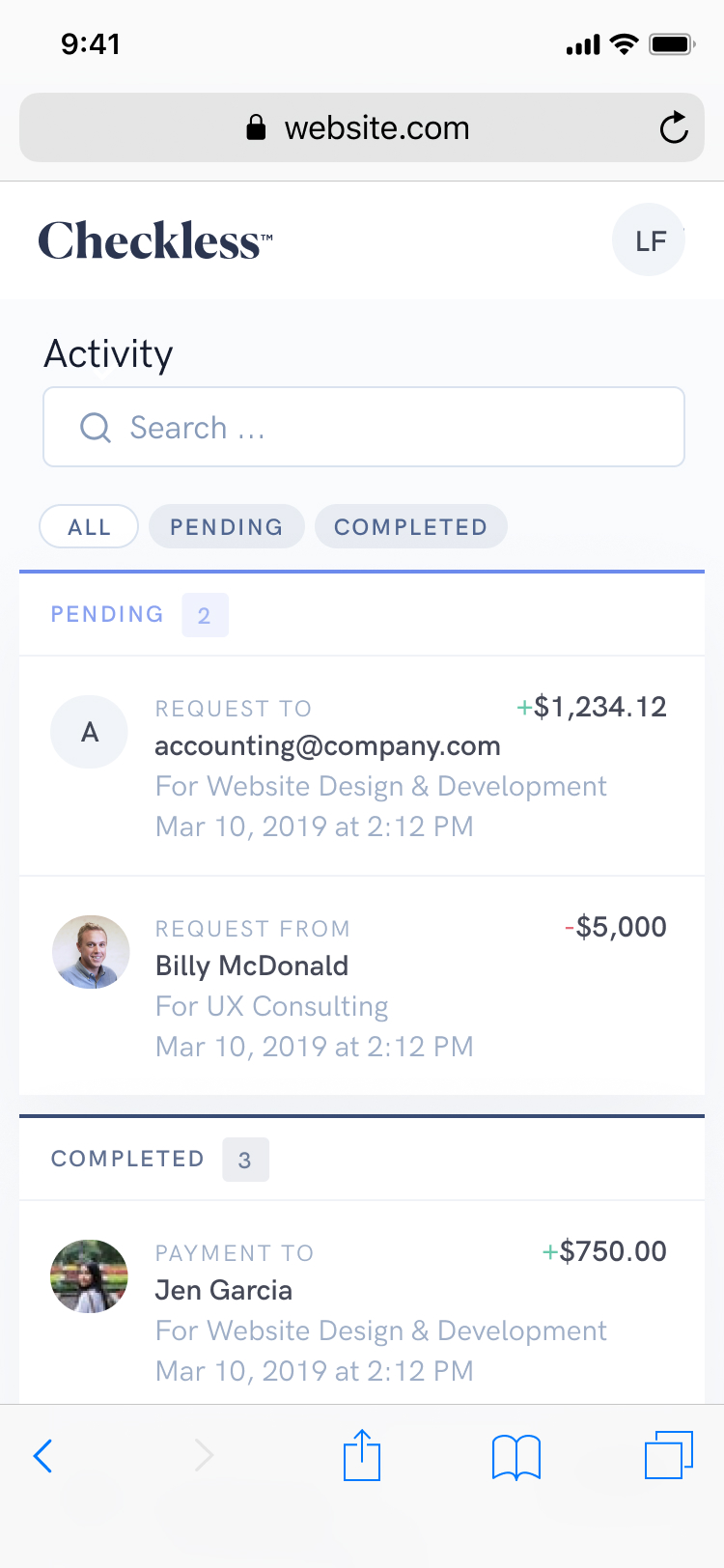

Get notified when it’s complete.

No more waiting in the dark for a payment to come in or go out.

Stop the madness—Go Checkless

The alternatives are a mess

Paper checks are a hassle

The hassle, cost, and physical nature of checks create inconveniences at each step of the process. Waiting for paper checks to arrive is a feeling known too well by too many. The dreaded “have you sent it yet?” conversation creates unnecessary tension in the client-customer relationship and rarely uncovers the true status of the payment.

Credit card fees are absurd

Credit cards are the most common method for making digital business payments, and freelancers and consultants get stuck with the processing fees of around 3%. On a $1,000 invoice, $30 is lost on average in fees to the card processor.

Peer-to-peer payment apps aren’t for business

Consumer apps like Venmo and Square Cash aren’t focused on business use. Intertwining personal and business finances is a big mistake (just ask your accountant). While these apps work great, the transaction and business models are fundamentally different than ACH bank-to-bank transfers. These apps hold your money in the middle to prioritize keeping a balance, while still have variable fee models based on card payments and withdrawals cycles.

Frequently asked questions

It really is as easy as it sounds

How do I receive payment for my invoices through Checkless?

Checkless facilitates a payment transfer between the two bank accounts of the verified participants in transaction. We never hold your money, never ask for your account and routing number, and never share your information with other parties.

How do I connect my bank account?

ACH bank-to-bank direct transfers happen between two bank accounts (just like a check). Connecting a bank account to Checkless is simple with the help of Plaid, who makes bank authorizations by letting you log directly into your bank to link an account.

Is Checkless safe?

We use bank grade encryption to keep your information safe. We never have access to your bank credentials and our payment processor maintains compliance with the SOC 2 framework, which provides an independent, third-party assurance that we are taking the appropriate steps to protect our systems and our data. Using tokenization, sensitive information is only available using a temporary and constantly changing key (or token).

How does Checkless make money?

By charging a $3 flat fee per transaction. Cheaper than checks and card fees. It’s just $3 every time. No subscription.

What is ACH?

The Automated Clearing House (ACH) serves as the center of commerce in the United States by transferring money and information directly from one bank account to another. Essentially, ACH facilitates bank-to-bank transfers—the kinds of transactions that don’t go through credit or debit card networks. Only banks can initiate ACH transactions, which means users must link their bank account to Checkless in order to set a payment in motion.

How long does a payment take to deposit?

Not as long mail, that’s for sure. On average it takes about 3 days for the money to be deposited in the receiver’s bank account after the payment is sent. You’ll get updates all along the way.